Simply Invest means turning your financial dreams into reality with clear, straightforward strategies. Embrace the power of smart investing and watch your wealth grow effortlessly.

Know your options

Assess risk profile

Diversify, diversify

Review & Rebalance

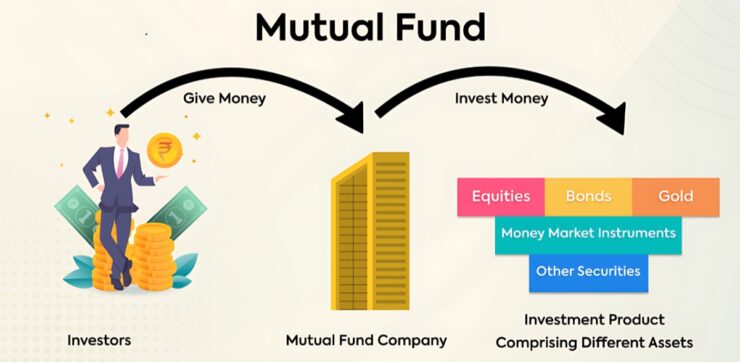

What are mutual funds?

Mutual funds pool money from investors to invest in diversified portfolios of stocks, bonds, or other assets, managed by professionals to achieve growth or income.

How does a Systematic Investment Plan (SIP) work?

SIPs allow you to invest a fixed amount regularly in mutual funds, averaging out market fluctuations and benefiting from the power of compounding over time.

What is the benefit of starting early with mutual funds?

Starting early maximizes the benefits of compounding, allowing your investments to grow substantially over time, potentially yielding higher returns for long-term financial goals.